February 21, 2026

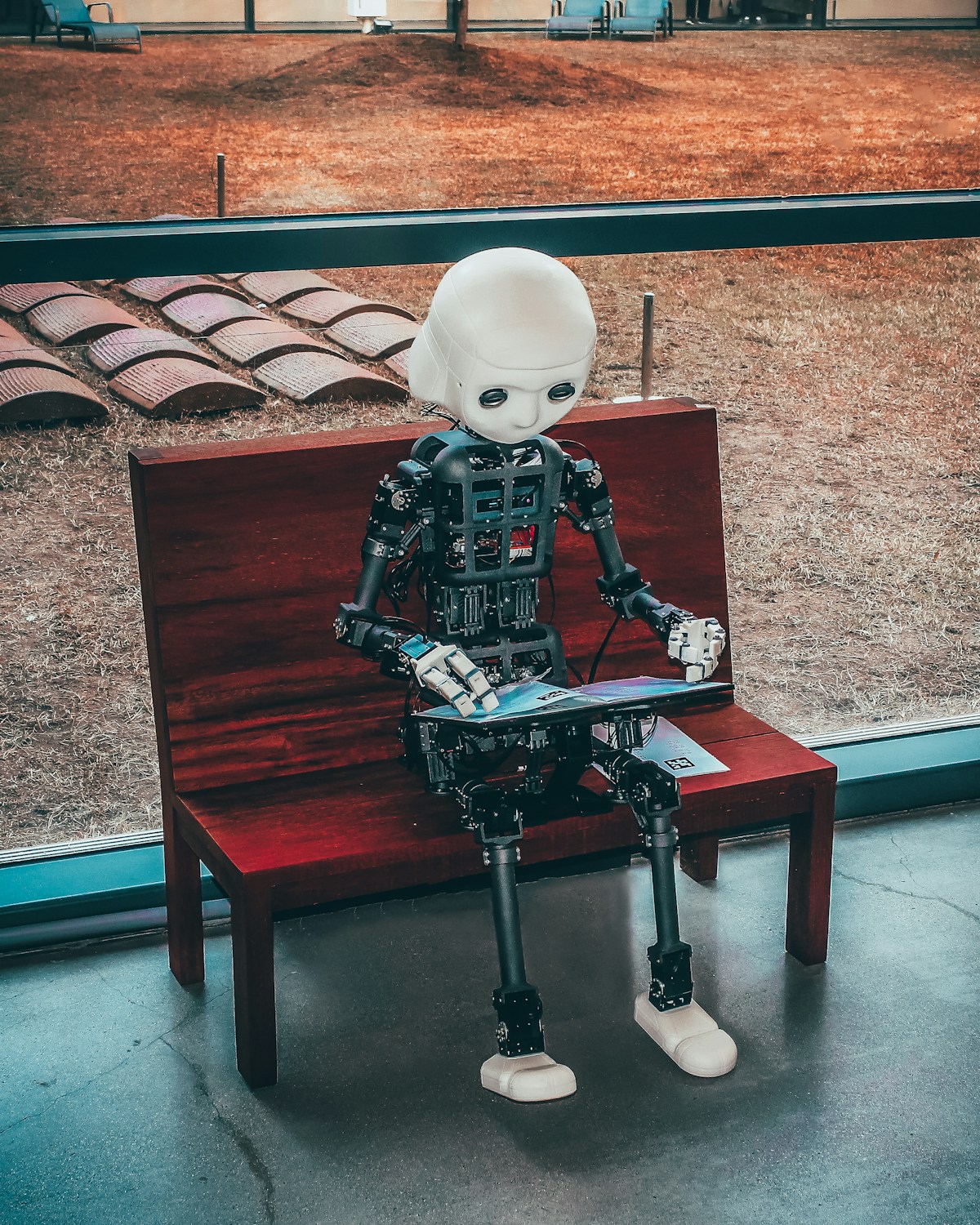

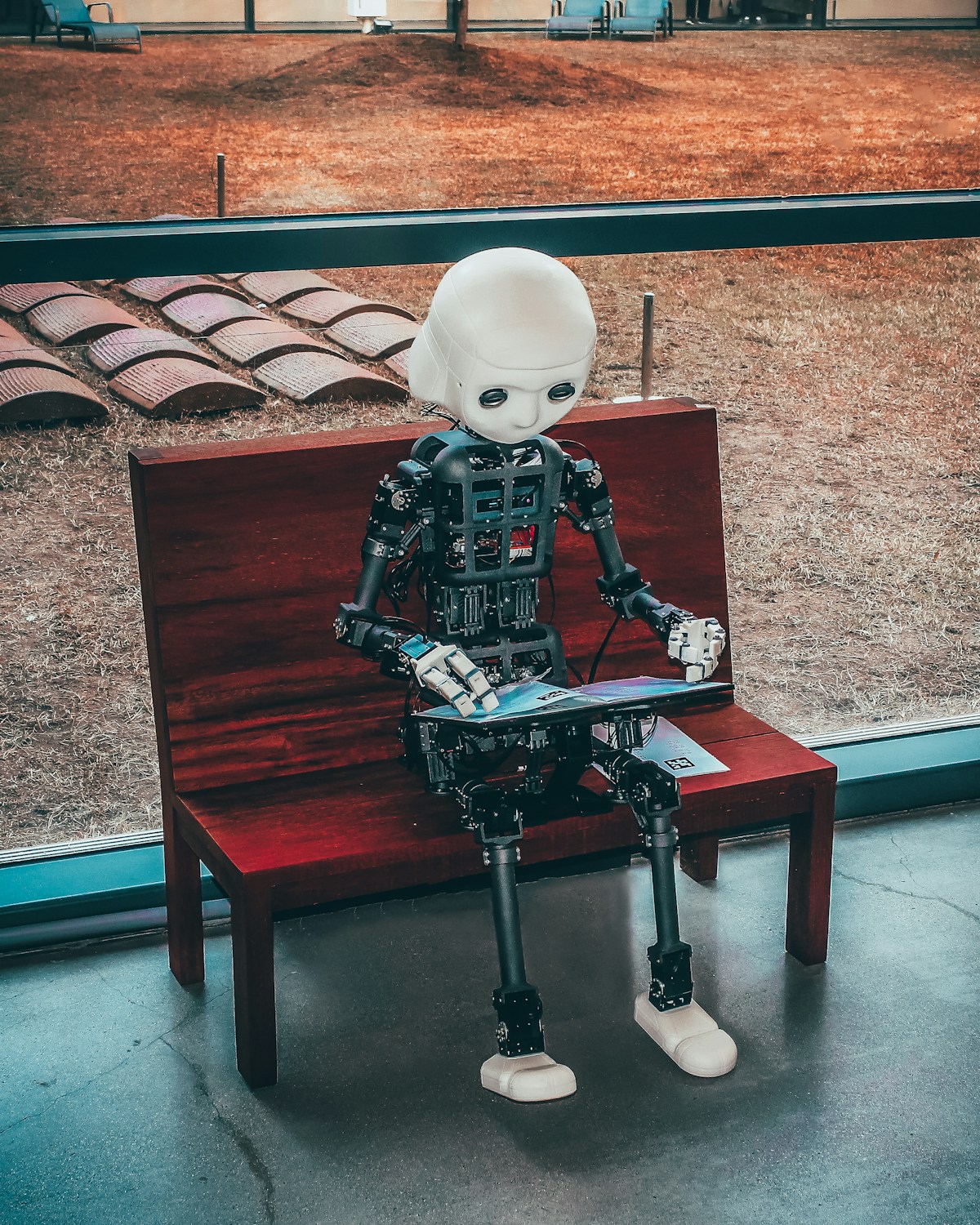

There’s a growing narrative in crypto that AI agents will be a massive catalyst for blockchain adoption. Agents will never have bank accounts, they need to pay for things, therefore they need crypto. QED, number go up.

June 9, 2025

Earlier this month I attended my second Bitcoin Conference, held at The Venetian Resort in Las Vegas.

April 16, 2024

Last week, Isabella Santos released an 11 minute video entitled “Ethereum – How a Lie Became Worth Billions”, which has had a good number of views and retweets. I watched it and am sorry to say that it contains a large number of inaccuracies and bad assumptions. I made some...

November 30, 2022

On 23rd November 2022, Alexey Sharp of the Erigon team announced that Erigon were winding down support for the Akula client which they had been developing for nearly two years. During that time there were 722 commits from 21 contributors, with the vast majority being single-handed work from Artem Vorotnikov....